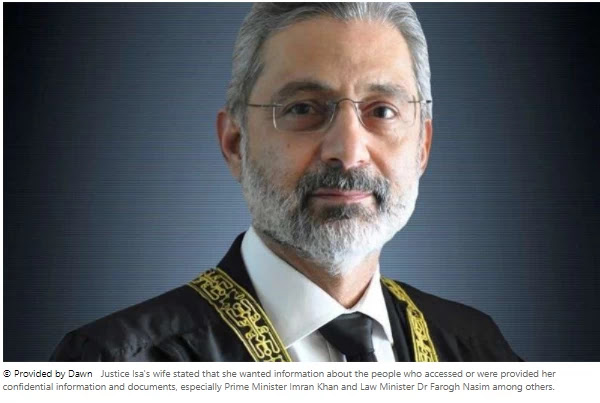

Justice Qazi Faiz Issa's wife, Serena Issa, had on Saturday alleged that since her secret and legally secure income tax and bank records had been’ illegally accessed, she was concerned about them. They also want the same information as their details.

In a statement, Ms Isa said she wanted

information about people with whom she had access to classified information and

documents, particularly Prime Minister Imran Khan, Law Minister Dr Forough

Naseem, and Asset Recovery. Unit Chairman Mirza Shahzad Akbar, Dr Muhammad

Ashfaq Ahmed and complainant Abdul Waheed Dogar.

"They should not object because they

have held public office, while one of them, a government employee, has

complained that me and my family are not tax compliant," he said in a

statement. Is."

His statement on August 28 in response to

the notice issued by the Commissioner (IR) FBR on August 21 under Section 122

(9) and Section 111 (1) (b) of the Income Tax Ordinance (ITO) 2001. Has been’

linked to.

It said that she was a private person who

had never held a public office or held a public office and in the last two years,

she had earned a total of Rs 980, Rs 707070 and Rs 767676, Rs 4040 as tax. What

was and what was’ done.

It is said’ that the FBR wants to explain

every rupee earned during the last 38 years

Earlier, it issued two similar statements

in response to a notice issued by the board stating its position.

In response, he asked the FBR to submit

the income tax return on which the authority depended, adding that the board

wanted him to restructure his life and reimburse every penny earned through it.

Explain since he started working in Karachi American School about 38 years ago.

.

Highlighting Section 174 (3) of the ITO,

he reminded that the ordinance does not require an individual to maintain any

record for more than six years after the end of the tax year.

He asserted that his confession had been

obtained’ through torture, and that his confession had been obtained’ through

torture.

"Without prejudice to all my

constitutional and legal rights, I do not want to give you an excuse to accuse

me of not providing information," he said, adding that it was

"painful" for him. But it is clear that the Federal Board of Revenue

intends. Passing illegal and illegal orders because he does not want to be

bound’ by the law.

He alleges that the FBR claimed that it

could not justify the purchase of three properties in London and save so much -

one at 23 236,000 in 2004 and two at 24 245,000 and 27 270 in 2013,

respectively. In 000.

Referring to Section 116A of the Ordinance

enacted by the Finance Act 2018, when it first had to file a foreign income and

asset statement, it complied with the new legal requirement and filed its

return and statements regarding foreign income. Get it done Assets for tax year

2018 and again tax year 2019.

But the FBR has not clarified under which

section it was required to disclose foreign income and assets before the said

amendment.

Similarly, the FBR ignored its

agricultural income by explicitly relying on section 111 of the ITO and

presenting it as unclear income.

The statement further said that the Board

deliberately ignored the fact that the provision of Section 111 of the Ordinance

accepts income earned from agriculture on which the income tax paid under the

relevant provincial law has been deducted’ through Finance Act 2013. Was,

added.

Therefore, agricultural income cannot be

ignored’ regardless of whether provincial income tax was paid or the extent of

such payment was limited to adjustment.

He said he owns about 27,278 acres of

agricultural land, which was, managed, and operated by his late father, who

died on June 25, 2020’.

He said that he was continuing to earn a

decent income from his agricultural lands, spending some money on savings

certificates issued by the government.

READ MORE

0 Comments